When will used cars become affordable again?

Only those living under proverbial rocks would be unaware of the dramatic surge in vehicle prices over the last three years. The laws of economics applied before, during, and after the pandemic.

Only those living under proverbial rocks would be unaware of the dramatic surge in vehicle prices over the last three years. The laws of economics applied before, during, and after the pandemic.

Pairing reasonably healthy demand with limited availability initially eliminated new vehicle incentives. Before long, MSRPs were rising in response to a critical inventory shortages and high demand. The forces of a global supply chain crunch eventually propelled inflation to uncomfortable levels. Central banks responded with elevated interest rates, which, when combined with record-high MSRPs, sent average monthly payments to the moon.

All the while, Canada’s pre-owned vehicle market was tied at the hip to the new vehicle market. Much as budget-oriented pre-owned shoppers prefer to see used prices reflect their own preconceived notions of what a 10-year-old car should cost, the new and used markets do not — and can not — exist in their own independent vacuums.

It only takes consideration of a tiny corner of the market to understand why the many moving parts of different automotive markets actually move in response to one another. Use the Toyota Sienna and some rough math as an example. In pre-pandemic 2019, an entry-level Toyota Sienna was priced at $35,295. We can safely assume that five years later the Sienna has lost 50 per cent of its value. Call it $18,000 for a five-year-old base Sienna. Remember, it’s 2019, so Sienna production is strong enough to sustain demand at dealers, which means trade-ins are flowing and there is, consequently, decent selection of both new and pre-owned Siennas. You might have even scored a deal.

Fast forward to 2023 and the price of an entry-level Sienna has grown by nearly 20 per cent; rising interest rates driving payments even higher. Now, however, Sienna production isn’t strong enough to sustain demand at dealers, which means trade-ins aren’t flowing and there are, consequently, few Siennas available on the pre-owned market. That supply crunch is exacerbated by a three-year period of limited new availability. We can assume therefore that the five-year-old Sienna now isn’t losing 50 per cent of its value; it’s more like 40 per cent at worst. In other words, a five-year-old Sienna is now worth roughly $7,500 more than it would have been in pre-pandemic 2019.

But here’s the kicker: when rising new vehicle prices pull prices for late-model pre-owned vehicles higher, prices for older vehicles are pulled higher, as well. These factors are amplified when availability decreases; calmed when availability increases.

But that’s just one hypothetical example. What’s really happening in Canada’s used vehicle market, and is there any reason to believe used cars are going to be affordable anytime soon? Based on current market reports from AutoTrader.ca, J.D. Power Canada, and Canadian Black Book, here are 10 key numbers that illustrate just how warped Canada’s pre-owned market has become.

Average used car price

In each of the third-quarter’s three months, Canada’s average pre-owned prices decreased, month-over-month. Yet the average pre-owned price — $39,155, according to AutoTrader, is still nearly $9,000 higher than it was at this time in 2021.

How many weeks do you need to work to pay off a used car?

AutoTrader says that in the third-quarter of 2023, the average income-earning Canadian required 33 weeks of wages to afford a used vehicle. Think that’s high? It’s 55 weeks of income for a new vehicle..

What’s the average used pickup price?

One of the first automotive-related signs of the supply chain crisis in 2020/2021 was the sudden lack of availability of new pickup trucks. Pre-owned truck prices skyrocketed. Although the surge in prices has stabilized somewhat, average pre-owned pickup prices in the third-quarter were up 7-per-cent, year-over-year, according to AutoTrader. That translates to an eye-watering $48,787.

The most expensive place in Canada to buy a used car

Although vehicles are expensive, well, everywhere, pre-owned prices are highest on the west coast; lowest on the east coast. The average price of a pre-owned vehicle, AutoTrader says, is now $43,003 in British Columbia, up 3 per cent from 2022’s Q3. That’s about $7,500 more than the average price of a pre-owned vehicle in Atlantic Canada.

How does the average new car price affect used prices?

How is it possible for pre-owned prices to be so high? Pre-owned prices don’t necessarily rise hand-in-hand with new vehicles prices, but there are strong correlations. J.D. Power data shows that the average price for new vehicles in Canada has remained above $50,000 in nine consecutive months, from March 2023 through November.

Are new vehicle prices rising?

AutoTrader says the average new vehicle list price is now 43-per-cent higher than it was just two years ago in the third-quarter of 2021.

Canadian are borrowing money to purchase new vehicles

Automakers can justify this continuation of high new vehicle prices — consequently pulled pre-owned prices higher — because Canadians continue to show their willingness to make the math work. How? It’s not by paying out of pocket — Canadians are borrowing. And they’re borrowing over extended timelines. In November, J.D. Power says, 58 per cent of new vehicle transactions were financed with terms of at least 84 months.

Average monthly car payments are on the rise

With prices pulled higher and interest rates higher than much of the car-buying public has ever seen, payments invariably rise, as well. The average monthly payment on a used vehicle now, AutoTrader says, is around $650. That’s 40 per cent higher than it was at the onset of the pandemic.

Will used price decrease?

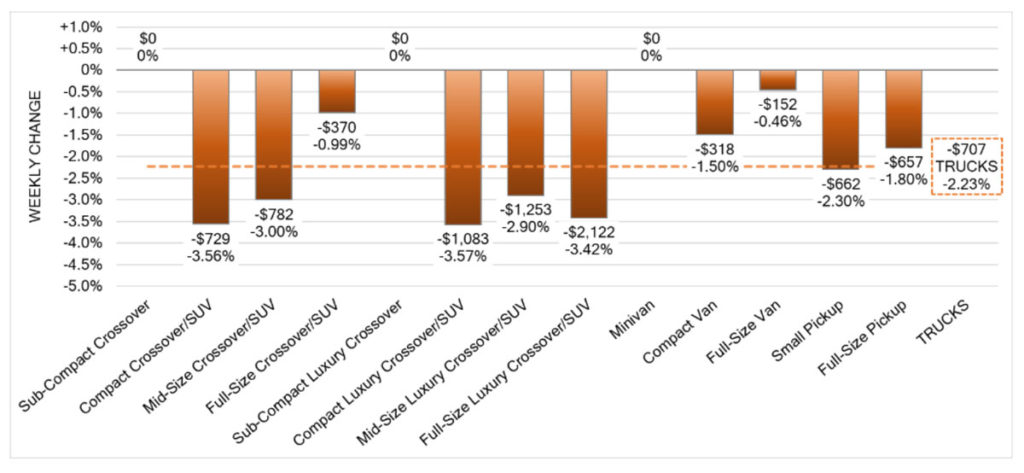

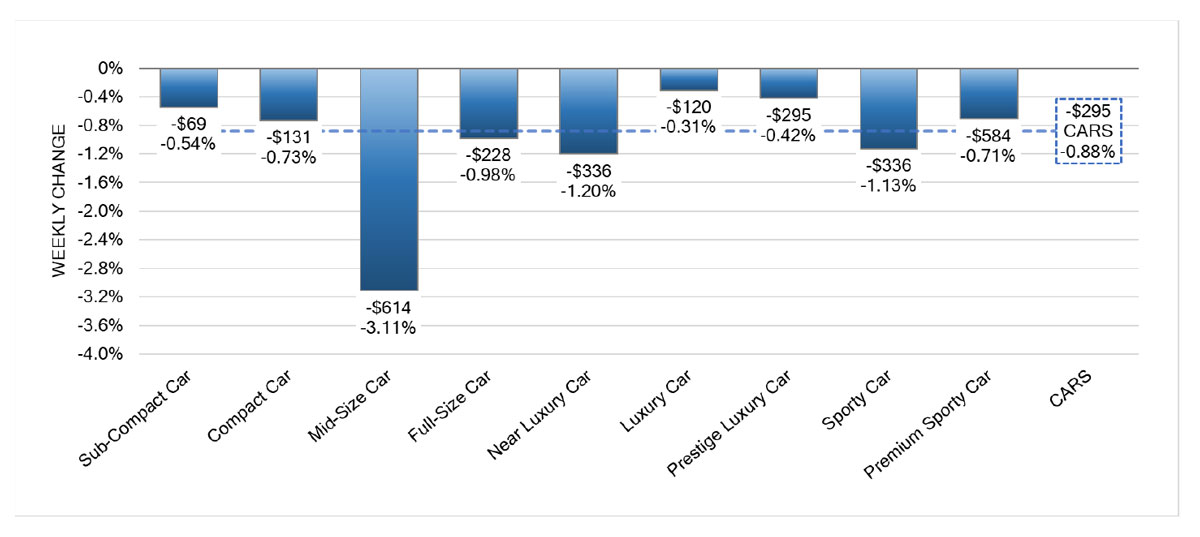

In the week ending December 2, the 48th week of the year, pre-owned wholesale vehicle values underwent the greatest weekly price decrease of the year, according to Canadian Black Book.

Which used vehicle category is increasing most?

The category experiencing the biggest year-over-year increase in pre-owned prices isn’t minivans, trucks, or SUVs — it’s passenger cars, with prices up 8 per cent compared to the third-quarter of 2022. “We are witnessing higher demand for more affordable/fuel-efficient vehicles,” AutoTrader says, a quest that historically drives buyers toward smaller and less costly sedans and hatchbacks.

Meanwhile, new cars are out of reach for so many people. The average price of a new passenger car is 52-per-cent higher this year than last, strikingly higher than the increases in other categories: 20 per cent for minivans, 16 per cent for SUVs, and 7 per cent for trucks. The cause, of course, isn’t just inflationary pressure — it’s the fact that affordable cars are disappearing from the market.

Can pre-owned vehicles become affordable? For that to happen, new vehicles have to become at least somewhat more affordable. And for that to happen, new vehicles have to become more available.

While “inventory levels are still down compared to pre-COVID levels,” according to AutoTrader, they’re rising rapidly. Year-over-year, inventory levels of key categories are far stronger now than they were at the end of 2022 Q3: 51 per cent for pickups, 70 per cent for cars, 71 per cent stronger for SUVs, and 101 per cent for minivans.

Cain, T. (2023, December 13). 10 Facts and figures that prove Canada’s used car market is still warped. Driving. https://driving.ca/column/driving-by-numbers/10-numbers-prove-canadas-used-car-market-warped-2023

Only those living under proverbial rocks would be unaware of the dramatic surge in vehicle prices over the last three years. The laws of economics applied before, during, and after the pandemic.

Only those living under proverbial rocks would be unaware of the dramatic surge in vehicle prices over the last three years. The laws of economics applied before, during, and after the pandemic.

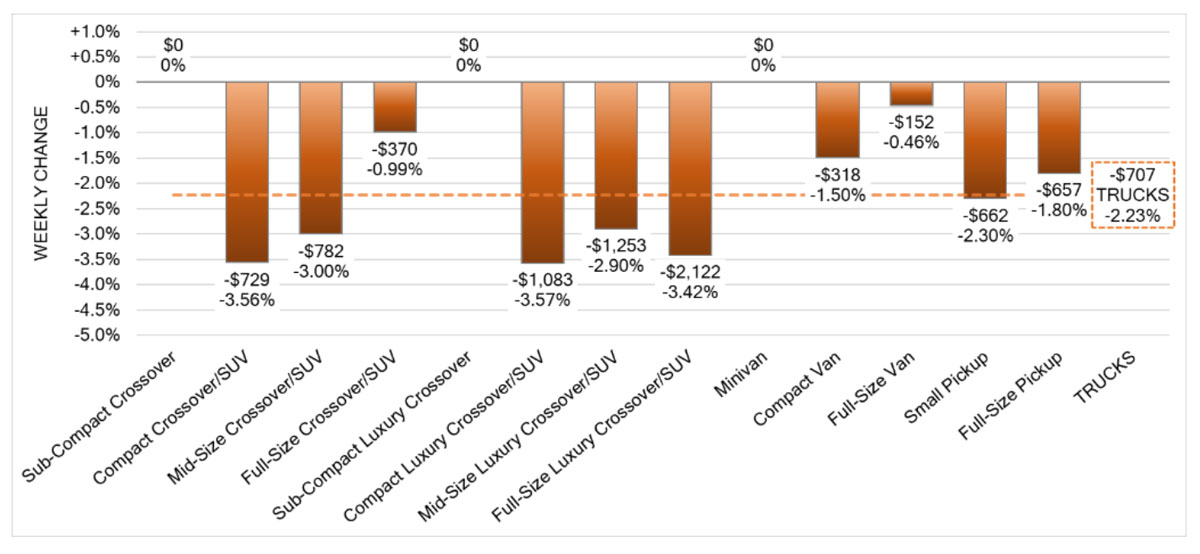

The Canadian used wholesale market saw its largest decline in prices yet, at –1.56%, for the period ending on Dec. 2. The prior week’s decline was only -0.38%, and Canadian Black Book’s Market Insights data indicates that the 2017-2019 average of the same week, a mere -0.31% in comparison, was significantly less steep.

The Canadian used wholesale market saw its largest decline in prices yet, at –1.56%, for the period ending on Dec. 2. The prior week’s decline was only -0.38%, and Canadian Black Book’s Market Insights data indicates that the 2017-2019 average of the same week, a mere -0.31% in comparison, was significantly less steep.

full-size luxury crossovers/SUVs (-3.42%) and mid-size crossovers/SUVs (-3.00%).

full-size luxury crossovers/SUVs (-3.42%) and mid-size crossovers/SUVs (-3.00%).

Wholesale vehicles price drops lessened a bit last week, with an average decline of 0.38%, says Canadian Black Book.

Wholesale vehicles price drops lessened a bit last week, with an average decline of 0.38%, says Canadian Black Book.