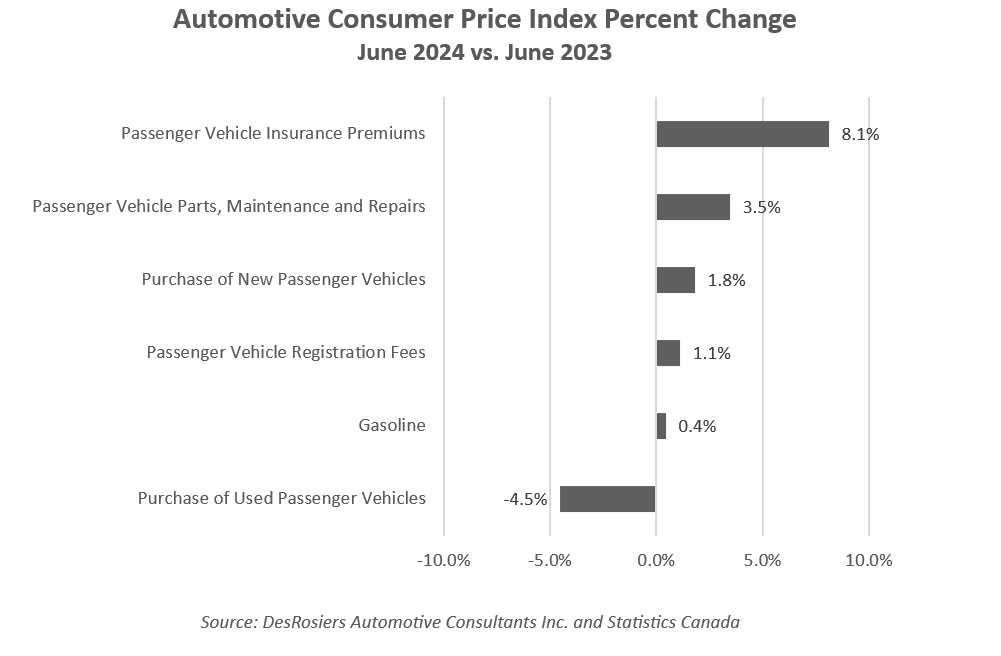

Over the period 2021-23 inflationary pressures were rampant throughout the economy and nowhere more than in the used vehicle market. Now with new vehicle supply shortages resolved, and the Bank of Canada starting a rate cutting cycle the picture has changed dramatically. To be sure, pockets of inflation persist – passenger vehicle insurance premiums remain a key source of price growth, rising 8.1% year-over-year in June 2024. Passenger vehicle parts and maintenance also saw a 3.5% increase as a category with maintenance and repair services themselves seeing a 4.2% increase and parts CPI up 2.9%.

However, used vehicle purchase prices have reversed course and started to decrease, dropping 4.5% compared to June of last year. This is in contrast to new vehicle CPI which remains positive at 1.8% – supported by the twin moves toward SUVs and ZEVs. Gasoline, meanwhile, acting as something of a stabilizing force, came in flat for June. Andrew King, Managing Parter at DAC commented that “It is clear that the automotive market is seeing countervailing forces at play.” He continued, “The new and used markets are heading in different directions as industry dynamics reshuffle the landscape and the market works toward a new equilibrium.”

Azarov, D., & DesRosiers Automotive Consultants Inc., D. (2024, August 7). Auto Industry Prices – Key Areas Diverge.