When U.S. President-elect Donald Trump launched the threat of a 25 per cent tariff on all products entering the U.S. from both Canada and Mexico, the automotive industry took notice.

While a lot of the focus has been on the negative impact on new vehicles and the auto parts industry, the damage to the used car supply could be considerable, according to a LinkedIn article from Brian Murphy, Senior Consultant with Clarify Group Inc. and the former Managing Director of Kelly Blue Book in Canada and Vice President Research & Analytics at Canadian Black Book.

The tariff concerns were sparked after Trump wrote on his Truth Social platform that the tariff “will remain in effect until such time as Drugs, in particular Fentanyl, and all Illegal Aliens stop this Invasion of our Country!” He has maintained that position in several media interviews since then.

Based on the Ivey Business School, industries in Canada that are most reliant on cross-border supply chains would experience the most severe impact. “The automotive sector especially, with 20 per cent of its inputs sourced across borders, faces significant cost increases and disruptions,” they said in an article posted on their website.

They also said companies would need to act fast to protect their operations, starting with a supply chain assessment that would help businesses pinpoint risks and prepare for potential disruptions.

Brian Murphy, Senior Consultant with Clarify Group Inc. and the former Senior Director of Kelly Blue Book & Data Solutions (Canada & Brazil) and Vice President Research & Analytics at Canadian Black Book, argued in a LinkedIn article that the impact a 25 per cent tariff could be devastating for the used car market — particularly in Canada.

His article was titled: “Happy New Year: unhappy used car price crash?”

“For those of you who don’t know (and I know many of you do!) about 200,000 to 300,000 used cars are exported every year from Canada to the U.S. This seems like a shockingly large number, and it is,” he wrote, noting that “the shipping of so many used cars out of this market has a major impact on supply, demand and prices here in Canada and the U.S.”

“If a 25 per cent tax is imposed, it would halt the export of used cars from Canada to the U.S. almost instantly,” said Murphy. “Once a 25 per cent tax is applied to a used vehicle, plus a few thousand dollars in shipping and handling fees, to export a car to the U.S. from Canada would likely not be a profitable enterprise.”

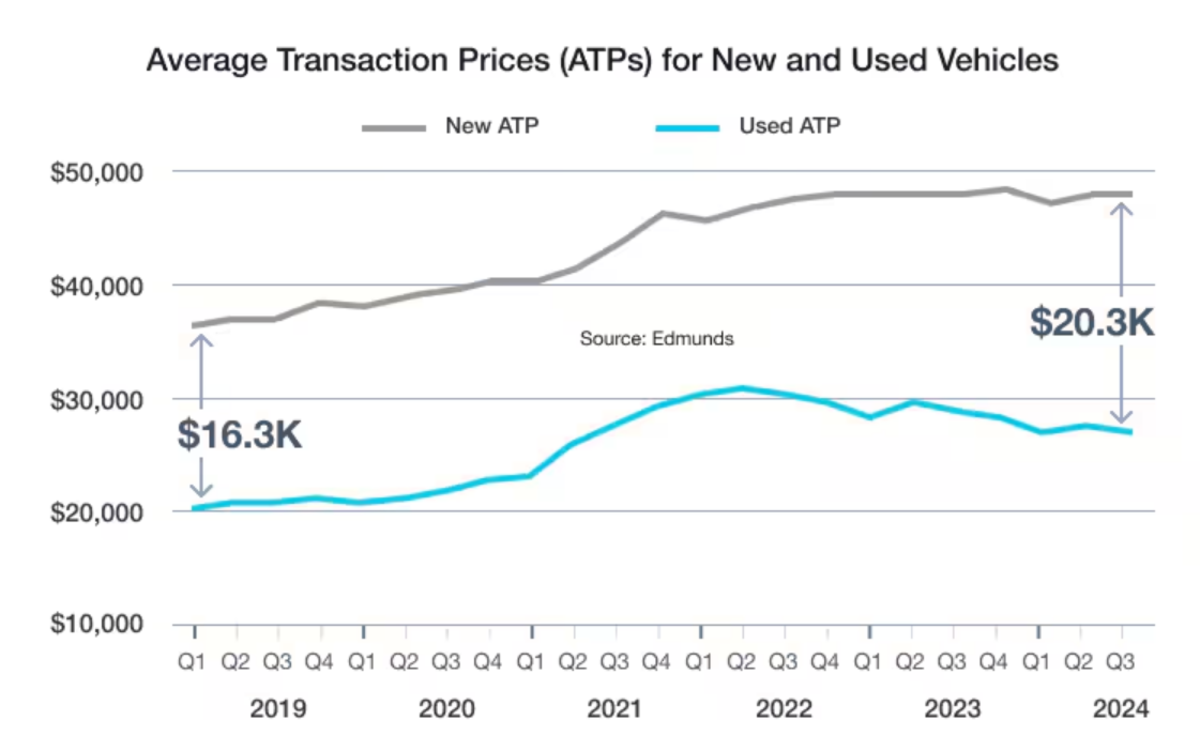

Murphy said used vehicle prices at wholesale would plummet, and that vehicles at lease return time would be worth much less.

While a 25 per cent tariff of the nature Trump has declared would likely violate USMCA provisions, the administration has been shown in the past to act on some threats — and use others simply as leverage.

Dealers might be wise to consider their exposure on their used car inventory in the coming weeks, and to keep tabs on whether the tariffs will be imposed.

The Canadian Automobile Dealers Association (CADA) wrote about the auto industry’s response to tariffs and the association’s involvement in an article in its newsletter CADA Newsline this week.

Phillips, T., Lefko, P., Lefko, P., dealer, C. auto, & Phillips, T. (2024, December 11). A 25% U.S. tariff would severely impact used cars. Canadian Auto Dealer. https://canadianautodealer.ca/2024/12/a-25-u-s-tariff-would-severely-impact-used-cars/