The average listed price for a used vehicle in Canada climbed to $37,900 at the end of April, a significant 9-percent increase from the $34,750 recorded at the beginning of that month.

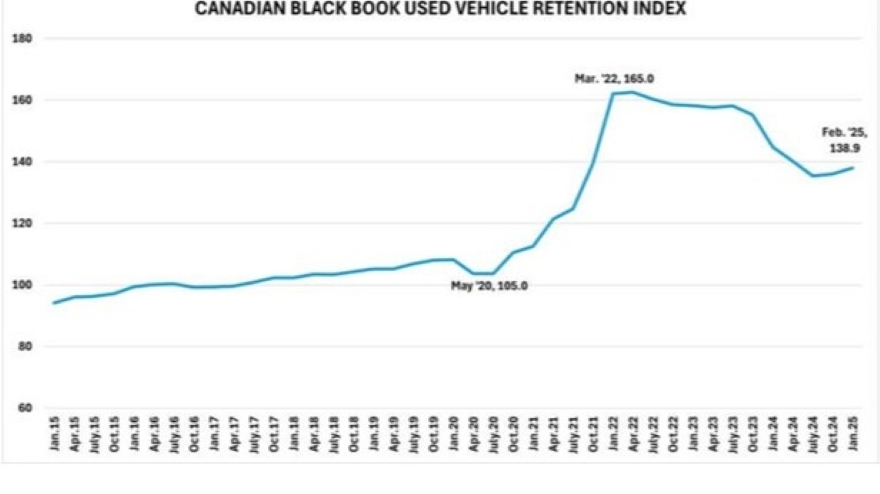

These figures come from the Canadian Black Book, which uses a 14-day rolling average to track the market. According to Daniel Ross, the outlet’s senior manager of industry analysis, the surge in pricing is due to sustained demand as Canadian dealers anticipate expected price increases on new vehicles.

And those increases, of course, are the expected consequence of the U.S. auto tariffs and Canadian retaliatory measures implemented in April.

Wholesale market: Quiet but stable

Unlike the retail price surge, the wholesale market remained stable in April. Increases observed in the light truck segments were offset by decreases in passenger cars. However, Daniel Ross emphasizes that the absence of a decrease is, in itself, excellent news, in a context where the wholesale market normally depreciates weekly.

Trade war: Cascading repercussions

Growing demand for used vehicles is not a surprise. Many analysts predicted that if American tariffs were implemented, many buyers would turn away from new vehicles.

The AutoTrader.ca outlet confirms that activity in the used car market remained “very hot” throughout April.

We know that the used car market was already under pressure since the pandemic, with limited supply. The arrival of buyers deterred from new cars due to price increases risks amplifying the strain on inventory.

An AutoTrader analyst adds, “Current inventories of new vehicles are temporarily protecting Canadian consumers. But this protection is limited in time.”

A short grace period

James Hamilton, managing director of the Used Car Dealers Association of Ontario, agrees. He believes that the reprieve offered by current inventories will be brief.

“Once these vehicles are sold, prepare for sticker shock on new vehicle prices.”

An increase in new car prices will create cascading pressure on the used car market, both on prices and inventory.

Exports under pressure

In recent years, around 300,000 to 400,000 Canadian used vehicles were exported to the U.S. each year — a tenth of the market, according to AutoTrader. Those exports were driven by a favourable exchange rate for Americans.

But the new tariffs—which affect both new and used vehicles—are disrupting the normal dynamic. Daniel Ross notes that American buyers have slowed their pace at Canadian auctions, adopting a more strategic approach, focusing on trucks, sports cars and luxury models.

Good news for Canadians?

A decrease in exports logically means that more used vehicles — particularly recent models from 1 to 5 years old — will remain in Canada. That could stabilize, or even reduce prices here.

The rapid price increase in April occurs within a complex and volatile commercial context. Dealers are seeking to adapt to a new tariff reality, while consumers will need to keep an eye out to avoid surprises in both the new and used car markets.

Charette, B. (2025a, May 20). Used vehicle prices rose by 9 percent in Canada in April: Car news: Auto123. auto123.com. https://www.auto123.com/en/news/used-vehicle-pricing-increased-canada-april-tariffs/72777/