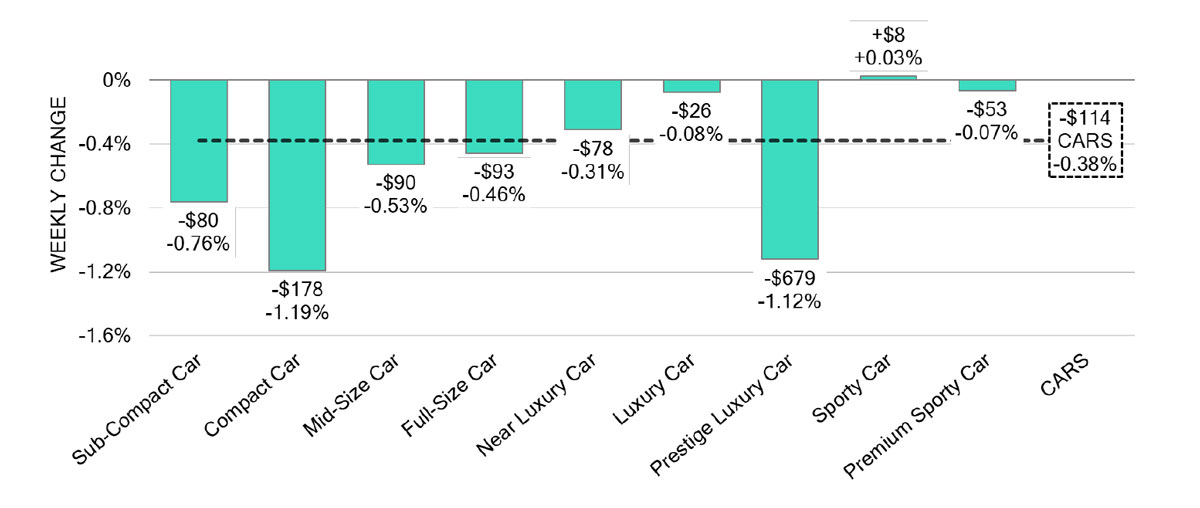

Declines in prices for the Canadian used wholesale market is less than the prior week — including for the overall car and truck/SUV segments, according to Canadian Black Book’s latest report covering the week ending on May 25.

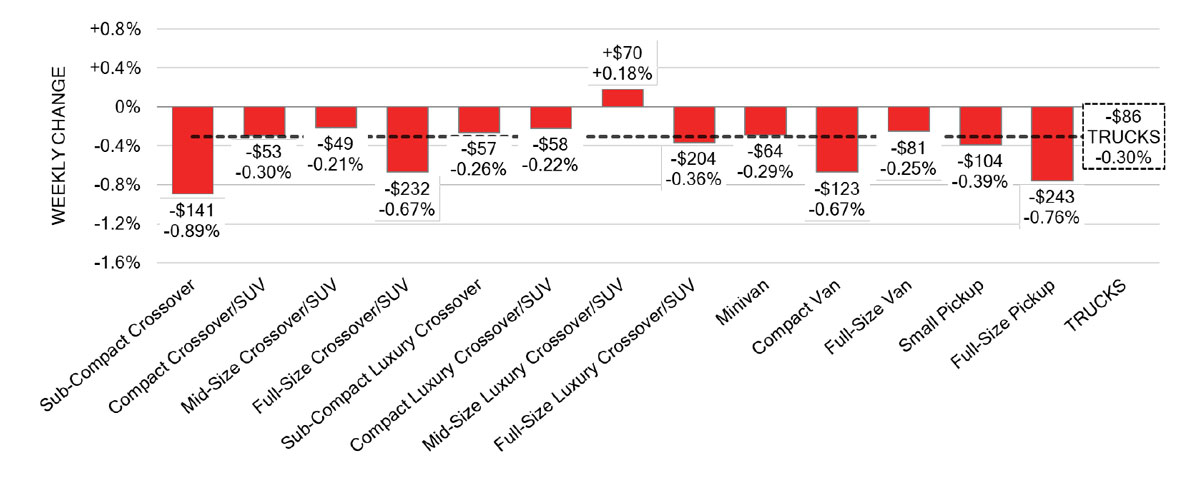

The market was down -0.23% this time, compared to the previous week’s -0.38%. The overall car category fell -0.33%, which is slightly less than the prior period’s -0.35%. And truck/SUV segment prices were down -0.14%, a decline that is less steep than the -0.40% of the prior week. No segments experienced an increase in values for the week.

“The Canadian market continued to decrease, with declines that (were) less than the prior week,” said CBB in its update. “Supply is building with stable demand for vehicles at auction on both sides of the border.”

In the United States, CBB said the market continues to report “normalcy,” with overall declines on-pace with pre-pandemic behaviour. “However, the trends aren’t one size fits all, with the trends of auction inventory and conversion rates varying from lane to lane, depending on the seller’s strategy and offered inventory.”

Back in Canada, premium sports cars experienced the least declines with -0.04%, followed by sports cars at -0.13% and near luxury cars with -0.18%. The most notable decrease came from luxury cars (-0.88%), followed by compact cars (-0.58%) and sub-compact cars (-0.55%).

As for trucks/SUVs, CBB said the segments with the most notable depreciations were full-size luxury crossovers/SUVs (-0.29%) and compact crossovers/SUVs (-0.26%). In addition, three categories showed no change in pricing: sub-compact luxury crossovers, minivans, and sub-compact crossovers.

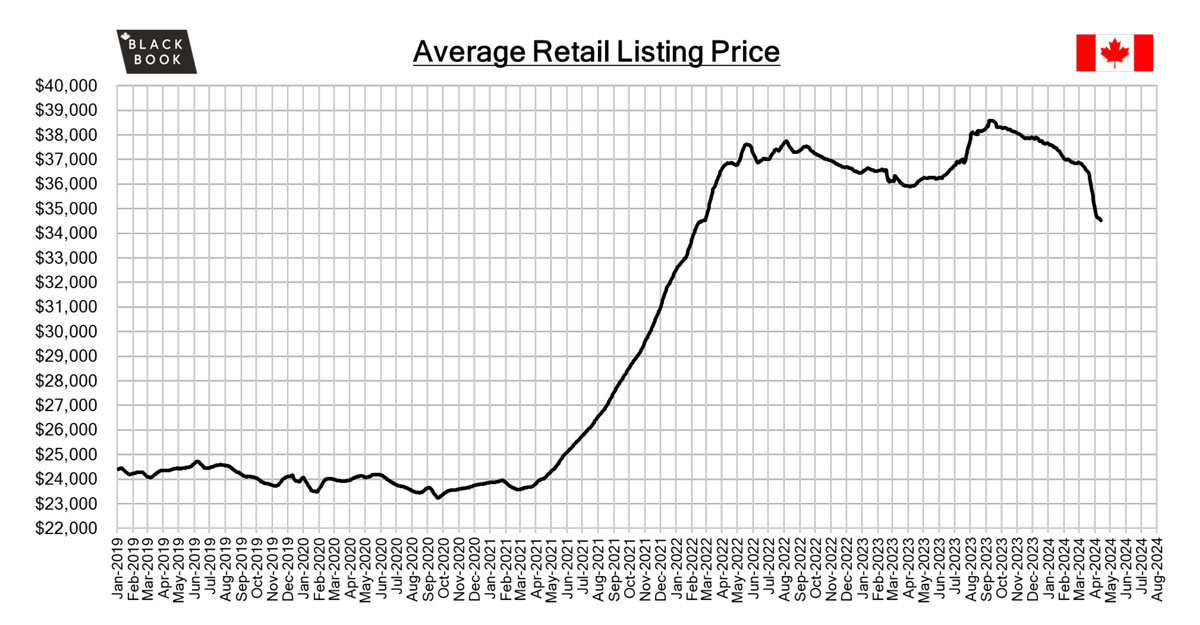

The average listing price for used vehicles, as per the 14-day moving average, was around $33,900.

The full report is available here.

dealer, C. auto, & Phillips, T. (2024, May 28). Used market price declines less intense as supply builds. Canadian Auto Dealer. https://canadianautodealer.ca/2024/05/used-market-price-declines-less-intense-as-supply-builds/

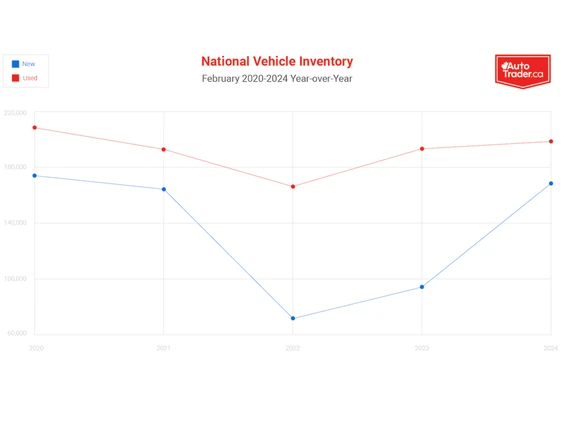

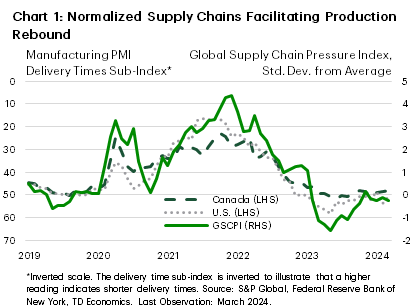

The automotive industry returned to a state of normality in 2023 as easing supply chain issues improved procurement times (Chart 1) and facilitated a rebound in production. As a result, North American light vehicle production increased 9.6% last year, putting total production only 3.9% below 2019 levels. This helped to push inventory levels to their highest level in three years to start 2024.

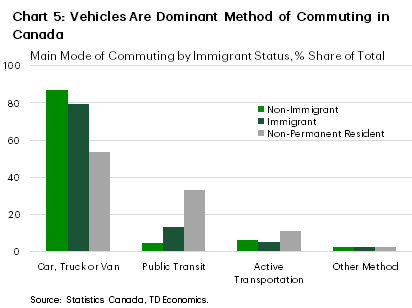

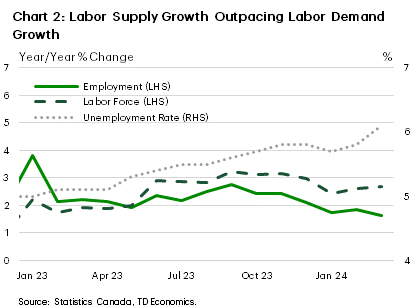

The automotive industry returned to a state of normality in 2023 as easing supply chain issues improved procurement times (Chart 1) and facilitated a rebound in production. As a result, North American light vehicle production increased 9.6% last year, putting total production only 3.9% below 2019 levels. This helped to push inventory levels to their highest level in three years to start 2024. The Canadian labor market is not quite as weak as is suggested by the one percentage-point increase in the unemployment rate over the past year. With the nation’s population growing by 3.2% last year, we have seen labor force growth outpace employment growth consistently since May 2023 (Chart 2), which has exerted upward pressure on the unemployment rate. Canadian job gains in 2023 actually exceeded those seen in 2019 by more than 100k jobs, but the economy would have needed roughly 160k additional new jobs to offset outsized labor force growth and keep the unemployment rate unchanged relative to the start of 2023. At the same time, while part-time jobs contributed more to last year’s gains than usual (25% vs. 3% in 2019), full-time job growth was above that seen in 2019. So, while the Canadian labor market is not remarkably strong, it is not currently in the doldrums either.

The Canadian labor market is not quite as weak as is suggested by the one percentage-point increase in the unemployment rate over the past year. With the nation’s population growing by 3.2% last year, we have seen labor force growth outpace employment growth consistently since May 2023 (Chart 2), which has exerted upward pressure on the unemployment rate. Canadian job gains in 2023 actually exceeded those seen in 2019 by more than 100k jobs, but the economy would have needed roughly 160k additional new jobs to offset outsized labor force growth and keep the unemployment rate unchanged relative to the start of 2023. At the same time, while part-time jobs contributed more to last year’s gains than usual (25% vs. 3% in 2019), full-time job growth was above that seen in 2019. So, while the Canadian labor market is not remarkably strong, it is not currently in the doldrums either.

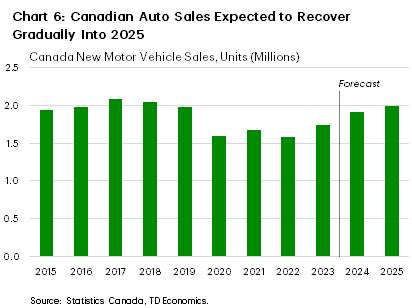

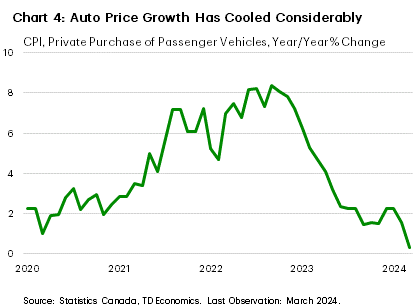

The first reason is owing to the delayed post-pandemic recovery in the automotive sector. The lack of available inventory in the market over the past three years has created a build-up of pent-up demand, which is one of the reasons why Canadian vehicle sales growth roughly matched that seen in the U.S. last year despite materially different economic trends. As production ramped up and supply levels gradually improved last year, consumers in both countries pushed sales to their highest level since 2019. This is expected to continue to support sales moving forward, with moderating vehicle prices (Chart 4) and lower financing costs providing support to this channel through the second half of the year.

The first reason is owing to the delayed post-pandemic recovery in the automotive sector. The lack of available inventory in the market over the past three years has created a build-up of pent-up demand, which is one of the reasons why Canadian vehicle sales growth roughly matched that seen in the U.S. last year despite materially different economic trends. As production ramped up and supply levels gradually improved last year, consumers in both countries pushed sales to their highest level since 2019. This is expected to continue to support sales moving forward, with moderating vehicle prices (Chart 4) and lower financing costs providing support to this channel through the second half of the year.