Wholesale Prices, Week Ending October 22nd

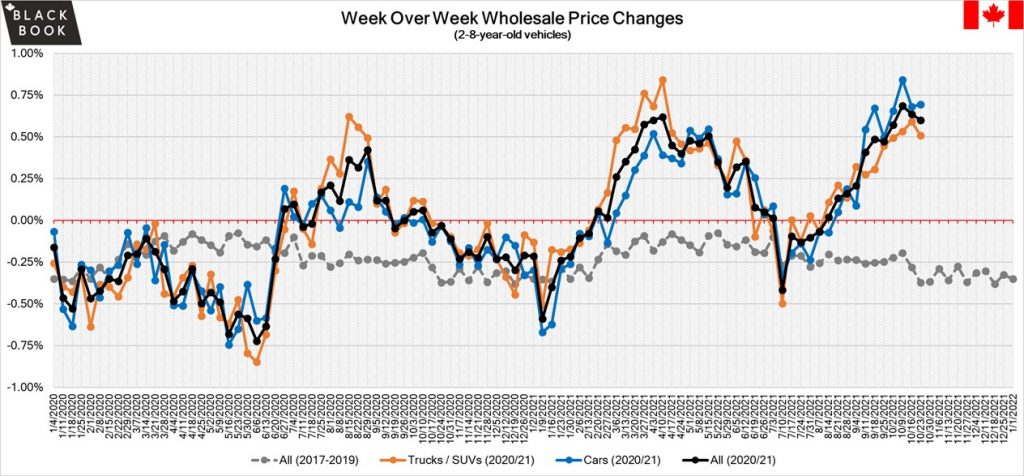

The Canadian used wholesale market continues to be red-hot, as prices increase for the 11th straight week. 21 of 22 vehicle segments saw prices rise for the week, as lack of inventory continues to drive wholesale prices higher. Overall, prices increased +0.60% for the week, with Car segments up +0.69% and Truck/SUV segments up +0.51%. The Near Luxury Car segment had the largest price increase (+1.80%) for the week, followed by Sub-Compact Luxury Crossover (+1.37%).

| This Week | Last Week | 2017-2019 Average (Same Week) |

|

| Car segments |

+0.69% | +0.68% | -0.44% |

| Truck & SUV segments |

+0.51% | +0.59% | -0.30% |

| Market | +0.60% | +0.64% | -0.37% |

Car Segments

• Overall, volume-weighted wholesale used car prices increased +0.69% for the week, continuing the positive trend for the 11th straight week.

• 8 of 9 car segments had prices increase – with only Prestige Luxury Car seeing prices decline for the week, down -0.16% from last week.

• The Near Luxury Car segment had the largest price increase for the week (+1.80%) followed by the Compact Car (+1.16%), and Sporty Car (+1.01%).

Truck Segments

• For the 8th consecutive week, all 13 Truck/SUV segments saw prices increase. Collectively, the Truck/SUV segments were up +0.51% for the week.

• The Sub-Compact Luxury Crossover segment had the largest price increase for Truck/SUV segments at +1.37%, followed by Sub-Compact Crossovers (+0.97%) and Compact Crossover/SUVs (+0.90%).

• Compact Luxury Crossovers/SUVs (+0.13%) had the smallest increase for the week.

Used Retail Prices & Listing Volumes

The average listing price for used vehicles continues to hit historic highs week-over-week, as the 14-day moving average now sits above $29,700. Analysis is based on approximately 120,000 vehicles listed for sale on Canadian dealer lots.

The number of used active listings continues to fall and now sits below 112,000 — the lowest point in the last 3 years. The 14-day moving average has now sits at ~111,800 units. Days-to-turn remains stable at ~48 days (unchanged from last week).

Volume

Used Retail

The CBB Listing Volume Index for used vehicles remained flat for the week. Currently the index sits at 0.87; dealers continue to deal with depleting inventory levels on both New and Used vehicles. Over the past 18 weeks, the used vehicle listing volume has seen significant declines.

Wholesale

The Canadian wholesale market continues to increase yet again. This past week, nearly all segments reported increasing values.

Supply remains low while demand continues to be strong on both sides of the border. Upstream channels continue to tap supply before it can be available at physical auctions.

Conversion rates remained strong this past week. Rates were observed into the 75% range on some lanes last week, with the few low kilometer, good condition units garnering high levels of bidding activity and premium pricing. In general, the quality of vehicles at auction remains somewhat below average as the supply of better-quality vehicles continues to be bought upstream.

The U.S. market exchange rate is similar compared to the previous week and remains favorable for exportation when price and demand are taken into consideration.

Canadian Black Book’s Market Insights

Economics & Government

• The Consumer Price Index rose 4.4% on a year-over-year basis in September, the fastest pace since February 2003 and up from a 4.1% gain in August.

• Year over year, consumers pay more for gasoline in September. Prices at the gas pump rose 32.8% compared to September last year.

• The Canadian dollar remains stable around the $0.81 to finish the week.

Industry News

• Toyota will spend $3.4 billion through 2030 to make automotive batteries in the U.S.

• Kia teases redesigned Sportage ahead of US debut next week.

• Polestar and Electrify America announced an agreement that will result in free fast charging over a period of two years for all Polestar 2 sold in the U.S.

U.S. Market

In the U.S., overall Car and Truck segments (+0.63%) increased for an eighth week; the prior week increased by +0.61%.

Volume-weighted Car segments increased +0.87%, compared to the prior week’s increase of +0.67%:

• All nine car segments reported gains again last week.

• Mid-Size Cars increased for a tenth week in a row with a gain of +1.29% last week, an increase from the prior week’s already large gain of +1.11%.

• Compact Cars have also now reported ten consecutive weeks of increases for an average weekly increase of +0.68%.

Volume-weighted Truck segments increased +0.52%; the previous week had an increase of +0.58%:

• All thirteen truck segments reported gains last week.

• Full-Size Van values continue to push higher, now reporting increases thirty-eight out of the last thirty-nine weeks. The average weekly increase is +0.56%.

• Compact Vans have also had consistent week-over-week increases, with gains reported in thirty-six out of the last thirty-eight weeks, for an average weekly gain of +0.65%.